Data Collection

The project involves collecting news headlines related to stocks or financial markets from various sources such as financial news websites, APIs, or databases.

Data Preprocessing

After collecting the headlines, preprocessing steps are performed:

- Lowercasing: Converts all text to lowercase for uniformity.

- Removing Special Characters and Numbers: Cleans the text by removing non-alphabetic characters.

- Tokenization: Splits the text into individual words or tokens (not shown in the code snippet).

Feature Extraction (Bag-of-Words Model)

The CountVectorizer from Scikit-learn is used for converting text data into numerical format. It creates a matrix where rows represent documents and columns represent unique words in the text. Each cell in the matrix contains the count of a word in a document. For example, if you have documents like “I love apples” and “Apples are delicious,” the matrix would show counts for words like “I,” “love,” “apples,” “are,” and “delicious” across these documents. This helps in analyzing and processing text data using machine learning algorithms.

Example :

The Bag-of-Words (BoW) model is used to represent text data numerically:

from sklearn.feature_extraction.text import CountVectorizer

vectorizer = CountVectorizer(max_features=1000, stop_words='english')

X = vectorizer.fit_transform(headlines['headline_text'])

Machine Learning Model (Random Forest Classifier)

The Random Forest Classifier is chosen as the machine learning model for sentiment analysis:

For stock sentiment analysis, imagine you have a dataset of news headlines related to a particular company, say Tesla. Each headline is labeled with sentiment: positive, negative, or neutral. Using machine learning techniques like the Random Forest Classifier, the model learns patterns in these headlines and their sentiments. When new headlines come in, the model predicts their sentiment. Investors can then use these sentiment predictions as part of their stock trading strategies. For instance, positive sentiment might indicate a good time to buy Tesla stock, while negative sentiment could suggest caution or selling opportunities.

Python Code :

from sklearn.ensemble import RandomForestClassifier

rf_classifier = RandomForestClassifier(n_estimators=100, random_state=0)

rf_classifier.fit(X_train, y_train)

Training and Testing

The dataset is split into training and testing sets for model training and evaluation:

from sklearn.model_selection import train_test_split

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=0)

Prediction and Sentiment Analysis

The trained Random Forest Classifier predicts sentiment labels for new headlines:

y_pred = rf_classifier.predict(X_test)

Evaluation and Performance Metrics

The model’s performance is evaluated using metrics like accuracy, precision, recall, and F1-score to assess its effectiveness.

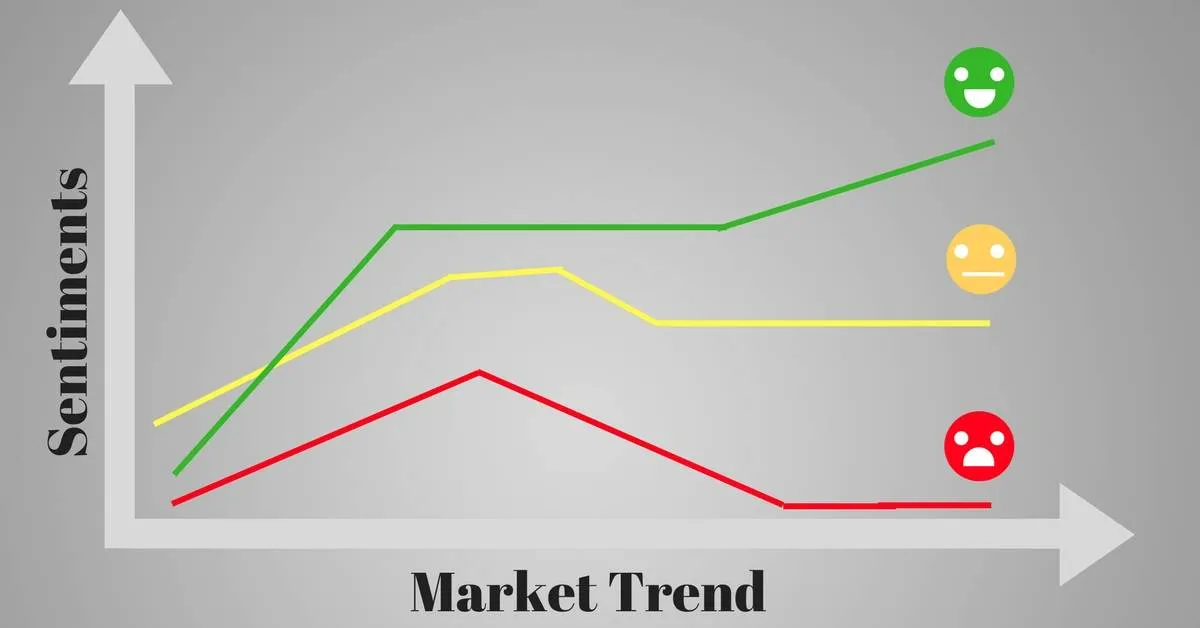

By combining these steps with appropriate data, the project can analyze sentiment in stock market news headlines and derive insights into market sentiment trends, which are valuable for investment decision-making and market analysis.

-

Accuracy: If our sentiment analysis model correctly predicts the sentiment (positive, negative, neutral) of 800 out of 1000 stock news articles, the accuracy would be 80% (800/1000). It measures how often the model is correct across all classes (positive, negative, neutral).

-

Precision: Out of the 200 news articles predicted as positive sentiment, 180 were actually positive. The precision would be 90% (180/200). It indicates how many of the articles labeled as positive sentiment are genuinely positive.

-

Recall: Out of the 300 actual positive sentiment articles, our model predicts 180 correctly. The recall would be 60% (180/300). It measures how many positive sentiment articles our model managed to capture.

-

F1-score: If precision is 90% and recall is 60%, the F1-score (harmonic mean of precision and recall) would be around 72%. It offers a balanced assessment, considering both false positives and false negatives in sentiment predictions.

These metrics help assess the stock sentiment analysis model’s effectiveness in accurately categorizing news articles based on sentiment, which is crucial for making informed investment decisions in real-world scenarios.

For Python Code & Data : Click Here