The Union Budget 2024, presented by Finance Minister Nirmala Sitharaman, aims to strike a balance between continuity and growth. Leveraging higher dividends from the Reserve Bank of India (RBI) and public sector companies, the government plans to enhance existing welfare schemes and introduce new measures to boost employment. Key allocations for capital expenditure, defense, and subsidies remain consistent, ensuring sustained development in critical sectors.

Fiscal Consolidation and Tax Reforms

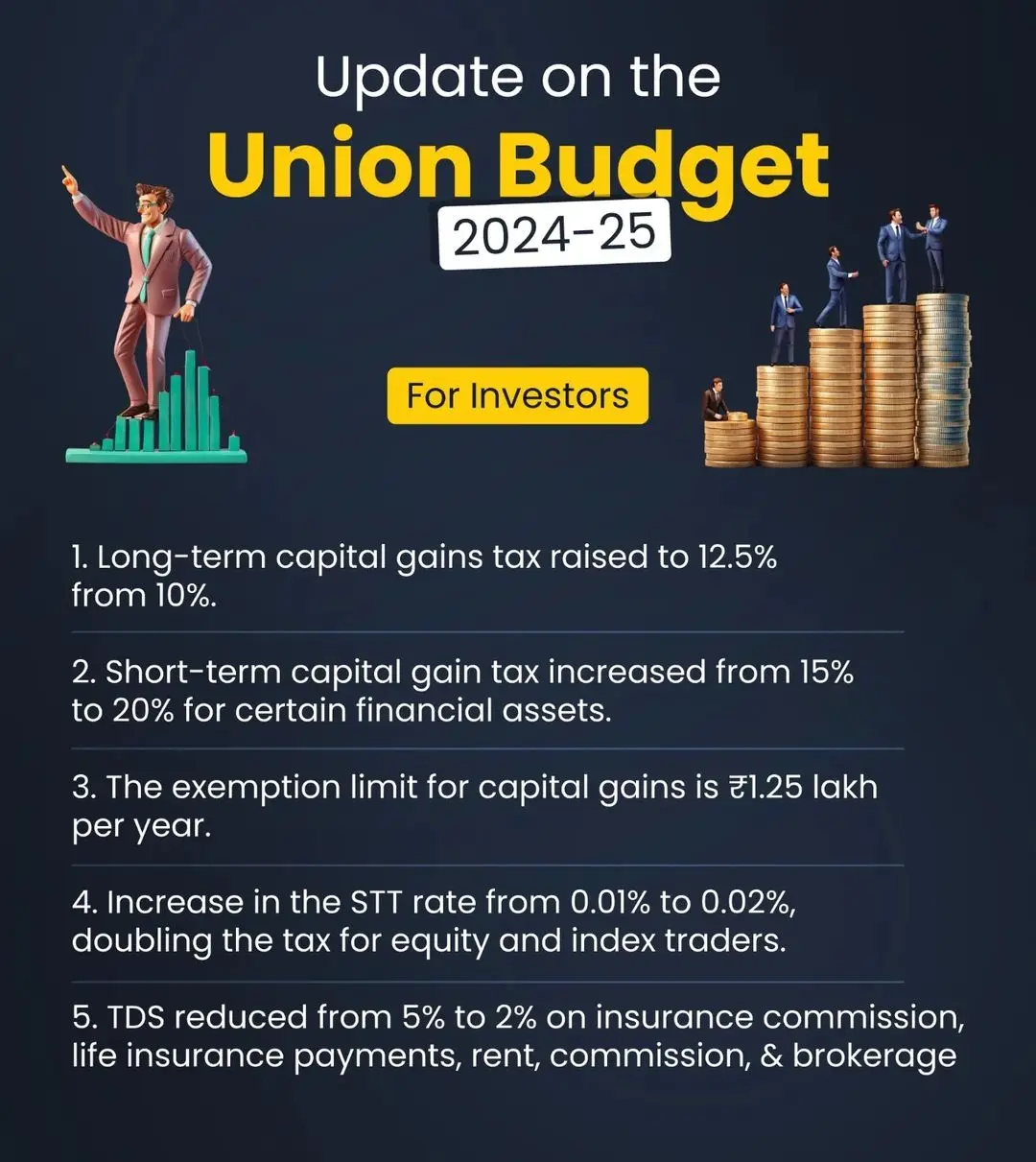

One of the standout features of the Union Budget 2024 is the government’s commitment to fiscal consolidation. The fiscal deficit for the financial year 2024-25 is set at 4.9% of GDP, down from the interim budget’s 5.1%. The Finance Minister aims to reduce the deficit to below 4.5% for the financial year 2025-26. Significant changes in capital gains taxation have been proposed:

- Short-term capital gains on certain financial assets will be taxed at 20%.

- Long-term gains on both financial and non-financial assets will see a tax rate hike to 12.5%.

- Real estate investments will lose the benefit of indexation, but this change aims to reduce the tax burden on properties purchased before 2001.

Key Changes in Capital Gains Taxation

| Asset Type | Current Rate | New Rate |

|---|---|---|

| Short-term financial assets | 15% | 20% |

| Long-term financial assets | 10% | 12.5% |

| Long-term non-financial assets | 10% | 12.5% |

| Real estate investments | Indexed | Non-indexed |

Real estate investments will lose the benefit of indexation, but this change aims to reduce the tax burden on properties purchased before 2001.

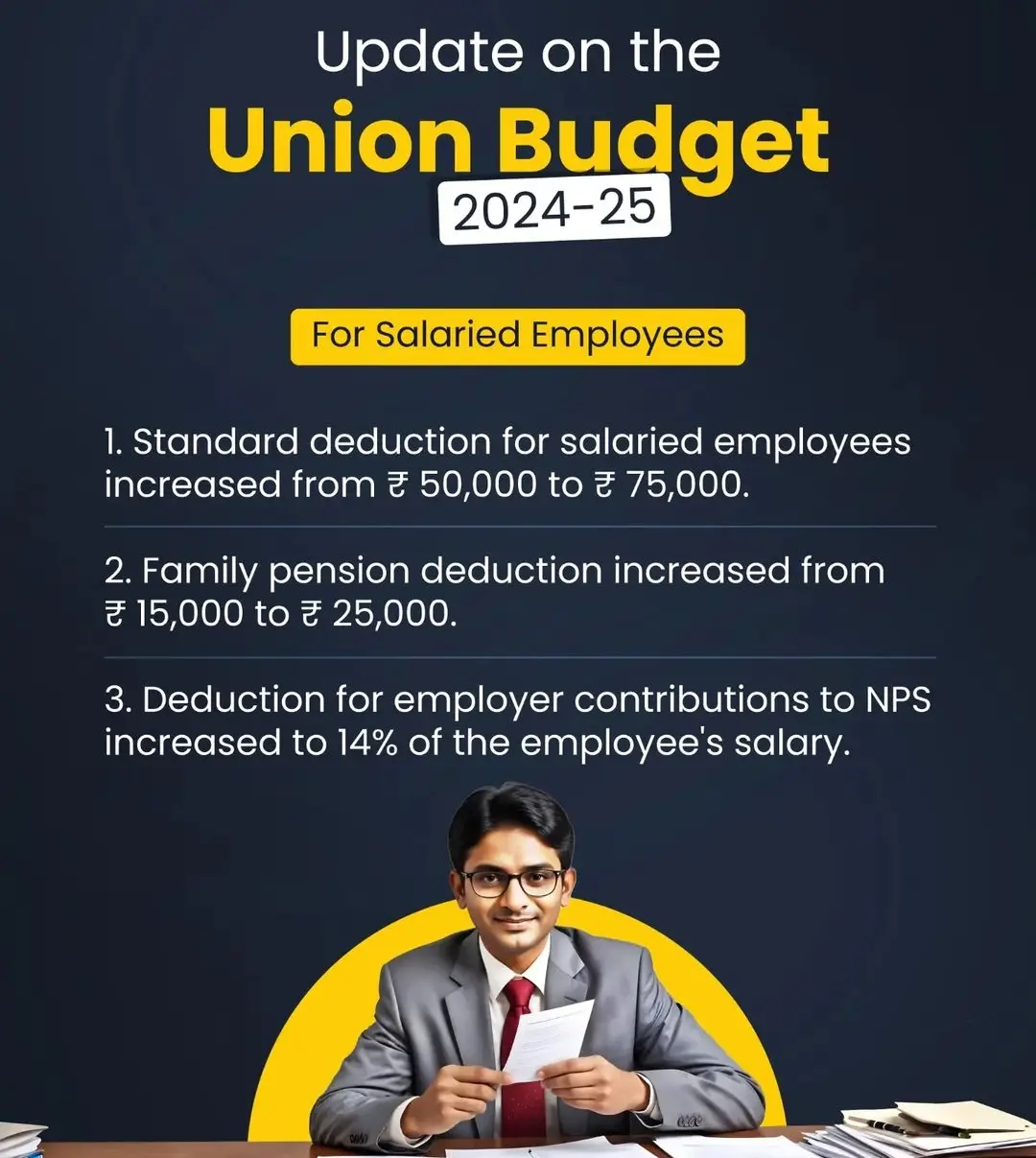

Relief for Individual Taxpayers

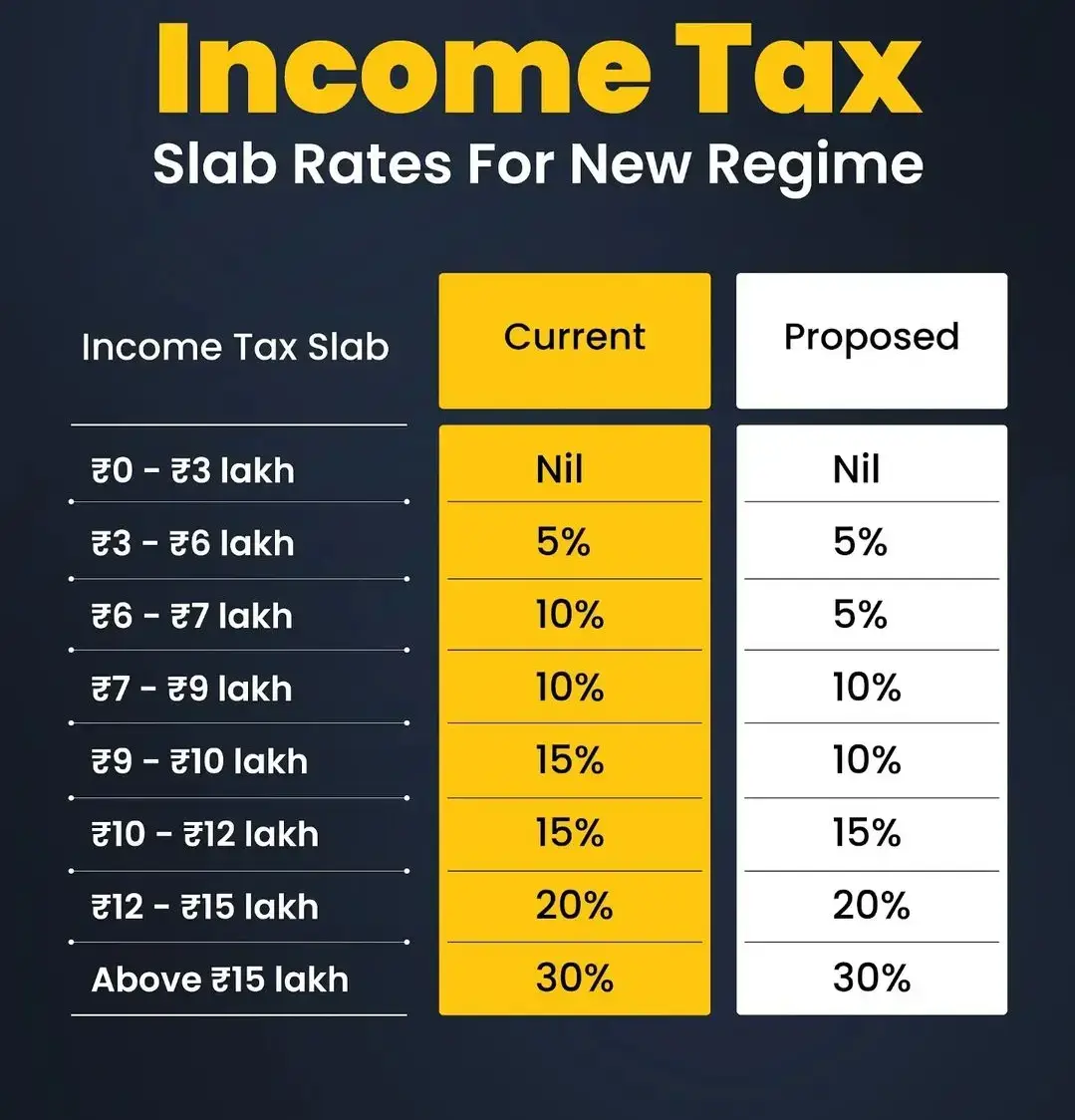

The budget brings considerable relief for individual taxpayers under the new tax regime:

- The standard deduction has increased from ₹50,000 to ₹75,000.

- Tweaks in tax slabs are expected to lower the overall tax burden.

These changes are projected to save a salaried employee up to ₹17,500 annually. Additionally, the abolition of the angel tax for all investor classes and the withdrawal of the 2% Equalization Levy on e-commerce transactions starting August 1st are expected to boost India’s startup ecosystem.

Support for Key Sectors

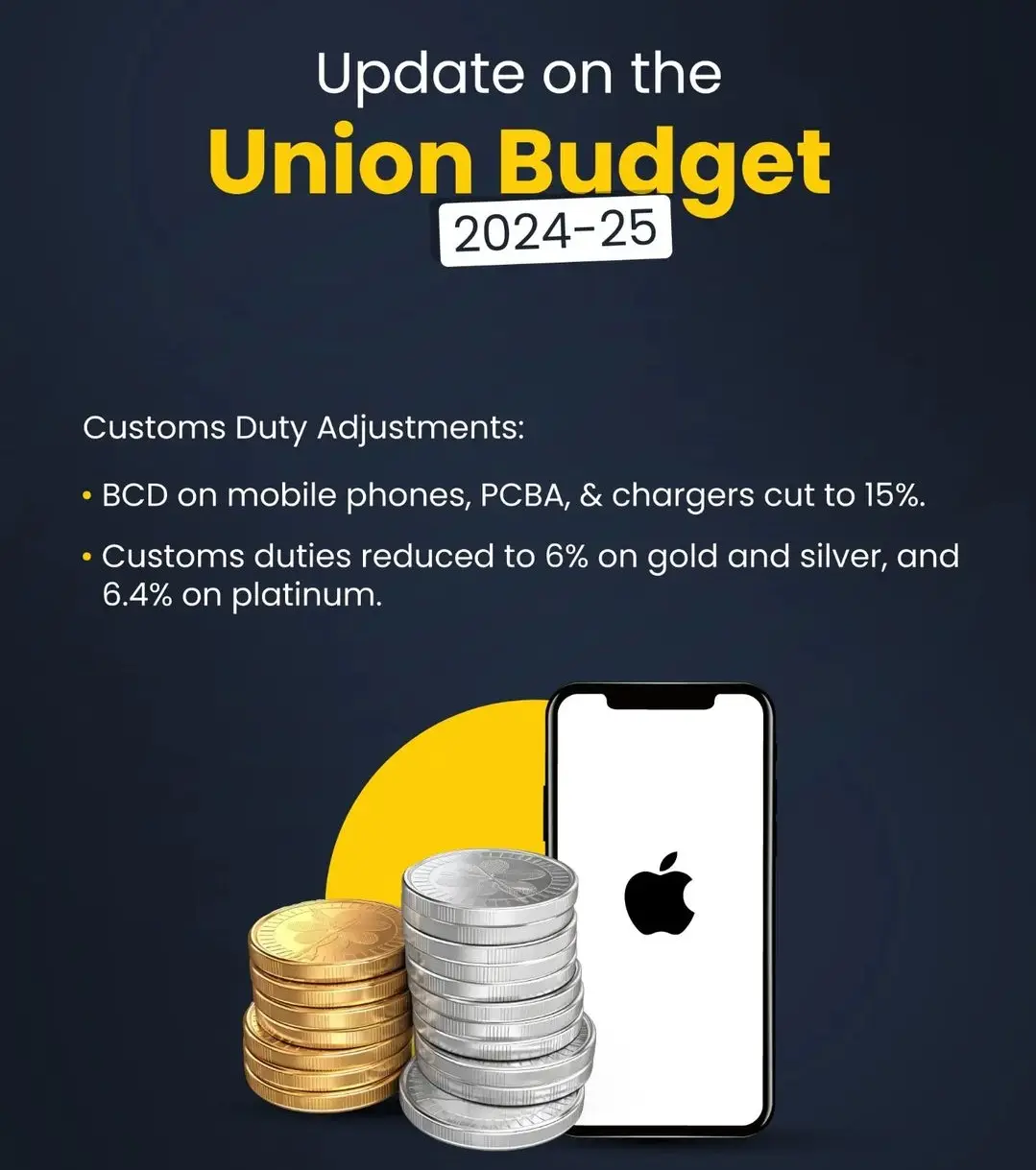

The Union Budget 2024 also introduces measures to support various sectors:

- Reduction in custom duties on input products for sectors like mobile phones, electronics, and jewelry is expected to make these goods cheaper.

- Enhanced allocations for welfare schemes aim to provide a further stimulus to the economy.

Reduction in Custom Duties

| Sector | Input Products | Expected Impact |

|---|---|---|

| Mobile phones | Various components | Cheaper mobile phones |

| Electronics | Essential inputs | Reduced cost of electronic goods |

| Jewelry | Raw materials and inputs | Lower prices for jewelry products |

Conclusion

In summary, the Union Budget 2024 aims to balance fiscal discipline with economic growth. By focusing on welfare schemes, employment generation, and tax reforms, the government is laying the groundwork for a more equitable and prosperous future. These measures are designed to bolster key sectors, provide relief to taxpayers, and support the entrepreneurial ecosystem, ensuring that India continues on its path of robust economic development.

FAQs

What are the key highlights of the Union Budget 2024?

The key highlights include fiscal consolidation, tax reforms, increased standard deductions for taxpayers, support for the startup ecosystem, and reduced custom duties on input products for various sectors.

How does the Union Budget 2024 aim to support individual taxpayers?

The budget increases the standard deduction from ₹50,000 to ₹75,000 and tweaks tax slabs to lower the overall tax burden, potentially saving a salaried employee up to ₹17,500 annually.

What changes have been proposed for capital gains taxation?

Short-term capital gains on certain financial assets will be taxed at 20%, long-term gains on both financial and non-financial assets will see a tax rate hike to 12.5%, and real estate investments will lose the benefit of indexation.

How will the Union Budget 2024 support India’s startup ecosystem?

The budget abolishes the angel tax for all investor classes and withdraws the 2% Equalization Levy on e-commerce transactions starting August 1st, which is expected to boost entrepreneurial spirit and attract more funding into the sector.

What measures have been introduced to support key sectors?

The budget includes a reduction in custom duties on input products for sectors like mobile phones, electronics, and jewelry, aiming to make these goods cheaper and stimulate the economy.

For more information on India’s budget and other related topics, visit India Tips.